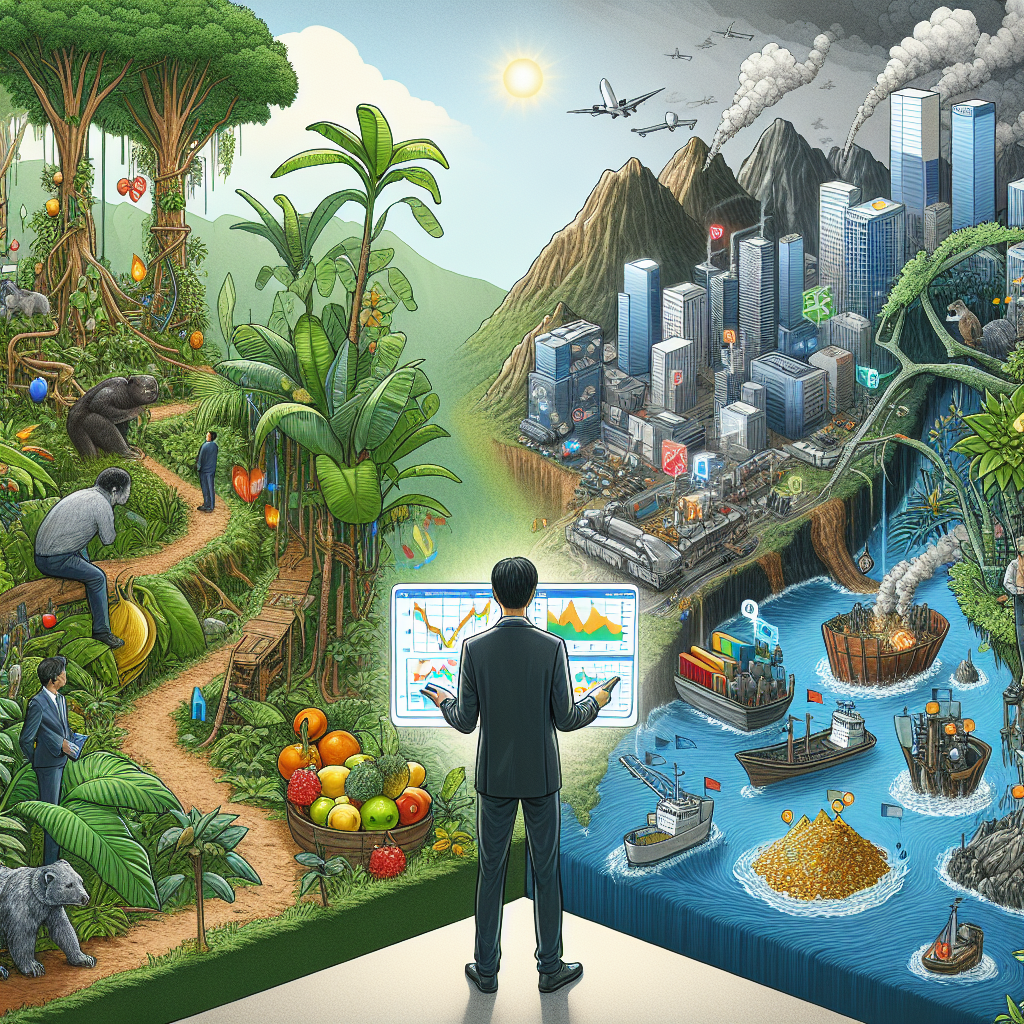

Emerging Markets: Opportunities and Risks for the Modern Investor

In the dynamic world of global finance, emerging markets present both tantalizing opportunities and formidable risks for modern investors. These markets, identified primarily in regions such as Asia, Latin America, Africa, and Eastern Europe, represent economies transitioning from low to middle income with rapid industrialization, improving governance, and burgeoning middle classes. As these nations integrate further into the global economy, savvy investors recognize the potential for high returns, albeit accompanied by significant volatility.

Opportunities in Emerging Markets

1. High Growth Potential:**** Emerging markets are often characterized by higher GDP growth rates compared to developed economies. Countries like China, India, Brazil, and Indonesia have demonstrated substantial economic expansion fueled by urbanization, increased consumer spending, and infrastructural developments. For investors, this translates into prospects for substantial capital appreciation in equity and real estate markets.

2. Demographic Dividends:**** Many emerging markets boast young, growing populations. This demographic trend supports a dynamic labor force and expanding consumer base. For instance, India’s burgeoning youth population is driving demand in various sectors, from technology to consumer goods, creating fertile ground for investments.

3. Undervalued Assets:**** In contrast to mature markets, assets in developing nations often remain undervalued due to perceived risks and limited market penetration. This undervaluation provides investors with opportunities to acquire stocks, real estate, or business ventures at attractive prices, potentially yielding high returns as the markets mature and valuation aligns with global standards.

4. Diversification Benefits:**** Investing in emerging markets allows modern investors to diversify their portfolios geographically. This diversification can reduce overall portfolio risk, as emerging markets do not always move in tandem with more established economies. Thus, they offer a hedge against downturns in developed markets, particularly during economic cycles where correlations between global markets remain low.

Risks in Emerging Markets

1. Political and Economic Instability:**** Emerging markets are often marked by political volatility and economic uncertainty. Issues such as policy changes, corruption, civil unrest, or abrupt shifts in regulatory frameworks can significantly impact investments. For example, political upheaval in countries like Venezuela or uncertainties surrounding elections in Brazil have led to substantial market disruptions.

2. Currency Risk:**** Fluctuations in exchange rates can erode investment returns. Many emerging market currencies are less stable and more prone to devaluation compared to major currencies like the US dollar or Euro. Investors must be cautious of how currency risks might affect their investments, as adverse currency movements can diminish gains or amplify losses.

3. Liquidity Concerns:**** Emerging markets often have less depth and liquidity compared to developed markets. This situation can make it challenging for investors to buy or sell assets without significantly impacting their prices. Liquidity issues are particularly pertinent in times of crisis when market participants rush to exit positions, exacerbating price volatility.

4. Regulatory and Governance Risks:**** Regulatory environments in emerging markets can be unpredictable and opaque. Inconsistent enforcement of laws, weak corporate governance, and lack of reliable financial data can pose significant challenges. Investors must navigate these complexities and often require due diligence and local expertise to mitigate risks effectively.

Balancing Opportunity and Risk

For the modern investor venturing into emerging markets, a balanced approach is essential. Here are some strategies to consider:

1. Comprehensive Research:**** Thorough due diligence is crucial. Understanding the political, economic, and social contexts of a target market can help in making informed investment decisions.

2. Diversification Within Emerging Markets:**** Investing across a variety of emerging markets can spread risk. An adverse event in one country may be offset by positive developments in another, helping to stabilize the overall investment portfolio.

3. Utilizing Professional Management:**** Engaging with mutual funds, exchange-traded funds (ETFs), or investment managers who specialize in emerging markets can provide expertise and local insights, potentially mitigating some of the inherent risks.

4. Risk Management Tools:**** Employing hedging strategies to guard against currency and market volatility can offer additional layers of protection, helping to preserve capital in volatile conditions.

In conclusion, emerging markets continue to offer a compelling mix of opportunities and risks. For investors willing to navigate the complexities, these markets can contribute significantly to achieving high returns and diversified portfolios. By exercising due diligence, leveraging professional insights, and employing sound risk management practices, modern investors can harness the growth potential of these vibrant economies while mitigating the inherent risks.

Leave feedback about this

You must be logged in to post a comment.