Credit Score Breakdown: How to Improve Yours in Six Months

Your credit score is more than just a number; it’s a pivotal factor affecting your financial trajectory. Whether you’re aiming to secure a mortgage, an auto loan, or even a new credit card, your credit score determines not only your eligibility but often the interest rates and terms you’ll be offered. Many people are unaware of how their credit score is calculated and how they can improve it over time. If you’re looking to elevate your credit score in the next six months, this article will guide you through the essentials.

Understanding Your Credit Score

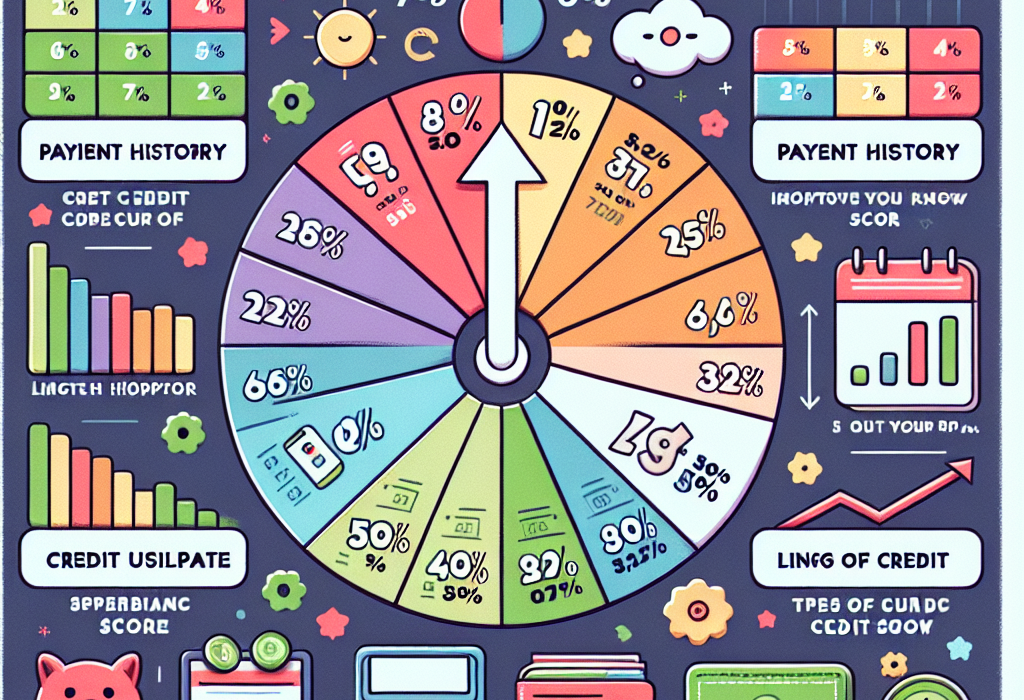

First things first, let’s break down the components that make up your credit score. The most commonly used credit score, the FICO score, ranges from 300 to 850 and is composed of five main factors:

Payment History (35%)

- Timely payments on credit accounts are crucial. Late payments, defaults, and collections significantly hurt your score.

Amounts Owed (30%)

- This is more than just the total amount owed. It’s also about your credit utilization ratio—the percentage of available credit you’re using. Ideally, you should keep this ratio below 30%.

Length of Credit History (15%)

- The longer your credit history, the better. This includes the age of your oldest account, the age of your newest account, and the average age of all your accounts.

New Credit (10%)

- Opening several new accounts in a short period flags you as a higher risk. Additionally, hard inquiries from lenders who check your credit can slightly lower your score.

- Credit Mix (10%)

- Having a variety of credit types—credit cards, installment loans (mortgages, auto loans, etc.)—can positively influence your score.

Month-by-Month Improvement Guide

Achieving a significant uptick in your credit score within six months is ambitious but doable. Here’s a month-by-month strategy to guide you through the process.

Month 1: Assess and Strategize

Obtain Your Credit Reports:

- Get a free copy of your credit report from all three major bureaus (Experian, Equifax, and TransUnion) at AnnualCreditReport.com.

Review Reports for Errors:

- Check for inaccuracies like incorrect account info, false late payments, or unfamiliar accounts and dispute them immediately.

- Set Your Goals:

- Determine your target credit score and what you need to achieve in each area (payment history, utilization rate, etc.).

Month 2: Tackle Late Payments and Reduce Debt

Prioritize Payments:

- Pay off or settle any overdue accounts. If current payments are hard to manage, consider contacting creditors to negotiate a payment plan.

- Reduce Credit Utilization:

- Aim to pay down balances on your credit cards, focusing on those with the highest interest rates or the highest utilization first.

Month 3: Optimize Credit Utilization and Diversify Credit Mix

Lower Utilization Ratio:

- If possible, make multiple payments throughout the month to keep balances low. This can immediately improve your score.

- Diversify Your Credit:

- Consider taking out a small credit-builder loan if you don’t have an installment loan on your report. Only do this if you can manage the additional payment.

Month 4: Build Positive History

Automate Payments:

- Automate minimum payments to ensure they’re made on time. Use reminders for additional payments beyond the minimum.

- Authorized User:

- If you can, become an authorized user on a responsible family member’s credit card. Their history on that card will reflect on your report.

Month 5: Light Credit Applications and Maintain Accounts

Limit Hard Inquiries:

- Avoid applying for new credit unless absolutely necessary. Each hard pull can slightly impact your score.

- Maintain Existing Accounts:

- Keep accounts open, even if you’re not using them frequently. Closing accounts can reduce your average account age and increase your utilization ratio.

Month 6: Monitor Progress and Reassess

Check Updated Reports:

- Review your credit reports again to see the progress and ensure that no new errors have emerged.

- Reevaluate Your Strategy:

- Compare your current score to your goal. Reinforce good habits like consistent on-time payments and low utilization.

Additional Tips

- Use Credit Responsibly: Small, regular use of your available credit coupled with prompt payments builds a strong history.

- Credit Counseling: If managing your credit seems overwhelming, consider credit counseling for personalized advice.

Improving your credit score is a marathon, not a sprint. It takes consistency, attention to detail, and smart financial habits. However, by staying committed to this six-month plan, you’ll be well on your way to a healthier credit profile, opening doors to better financial opportunities and peace of mind.

Leave feedback about this

You must be logged in to post a comment.